Is Growth Hurting the Transportation Alternative Delivery Market?

At a time when both funding and demand for infrastructure improvements are booming, the number of qualified contractors interested in performing work on large-scale infrastructure projects seems to be shrinking. The transportation industry has increasingly relied on mega-project design-build (D-B) and public-private partnerships (P3) contracts to implement critical corridor and long-span bridge projects, but recently contractors have been shying away from these risky projects.

Mega-projects are generally defined by the Federal Highway Administration (FHWA) as those $500 million or more in size. With so much at stake, mega-projects carry increased risk, take longer to design and construct and are more complex. As our infrastructure conditions deteriorate, construction, design and public officials have strongly advocated for increased funding for mega-projects.

But how will the industry respond if contractor competition continues to decrease for these major projects? Will elected officials reconsider transportation funding? Will it affect states seeking legislation for expanded transportation funding? Examining the dynamics of mega-projects may offer answers.

How did we get here? Industry Growth Perspective

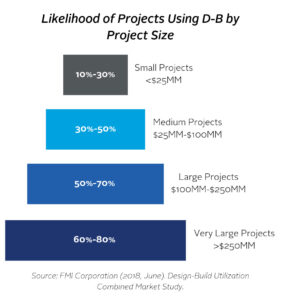

Investment in infrastructure has skyrocketed in recent years, with the promise of continued growth. Recent research provided by FMI Corp., a leading management consultant to the industry, has quantified that D-B project delivery is being used for 44% of the national public-sector transportation industry projects – a number projected to grow 7% annually in the next 3 years. Furthermore, P3 projects have become a necessity in rehabilitating our infrastructure. The P3 market is poised for continued growth as private investment in public projects fills federal funding gaps.

But, while the growth of alternative delivery projects has been supported, as the market has grown, threatening trends have begun to surface.

Growing Pains

- The average project size has increased, with $1 to $3 billion projects that carry extended construction schedules and more risk becoming more common.

- The growth in the transportation D-B market has stretched the fixed number of heavy civil firms capable of building these mega-projects.

- Limited resources, bonding capacity and the contract size are placing pressure on heavy civil firms.

- While most agencies espouse DBIA best practices, local legislation often dictates adoption of aggressive procurement schedules, limits procurement options, and restricts commercial terms, each of which can conflict with best practices.

- Mega-projects in their final years of construction are becoming a liability for contractors as increasing obligations weigh heavily on their balance sheet. The joint and severable liability clauses of contractor joint ventures serve to spread risks, but also expand their impacts.

- The architectural and engineering industry has experienced increased liabilities, and contract flow down provisions and insurance requirements have reduced the number of engineering firms willing to participate as partners on mega-projects.

Ultimately, as the alternative project delivery market has grown, the effects of increased liability, risk management procedures, bonding and insurance requirements, limited top-tier design partners and reduced profitability has led to a reduction of bidders on mega-projects $500 million or more in size.

Using a P3 to implement the I-595 corridor project aided in the on-time and on-budget completion of the project, more than 15 years earlier than the original plan.

Improving the Model

As contractors are forced to re-evaluate their risk versus reward models on a project-by-project basis and reduce their exposure accordingly, we must increase our understanding of market dynamics by striking a dialogue about the impacts of reduced competition. Contractors’ selectiveness in bidding projects goes beyond technical requirements; cost to pursue, limited resources, lack of teaming partners, and bonding restrictions or insurance pose factors in pursuing an alternative delivery project. Failing to address the situation could lead to rapid price escalation, forcing public agencies to reconsider procurement options.

As a professional who regularly advises agencies in procurement strategies on large capital projects, I believe these problems can be addressed if we understand both what causes them and why action is necessary. Here are a few suggestions I believe worthy of consideration:

- Reduce project size. Agencies should consider if mega-projects can be reduced through phasing or providing alternative procurement methods devised to reduce risk to the D-B teams while improving results for the public agency. Reduction in project size may increase the pool of contractors capable of bidding, creating more competition and competitive pricing.

- Address knowledge sharing. With the growth of the market, many agencies have seen managers retire or leave public service. How can organizations like DBIA, ACEC, ASCE and ARTBA assist in replenishing this talent through targeted training? While educational programs to assist public agencies are helpful, it takes experienced public sector managers to explain to legislators why excessive risk transfer is bad for the public. How can we edify elected officials who are advocating for increased public funding, yet under the pretense of unreasonable schedules?

- Examine progressive design-build (PDB). Though PBD seems to be gaining popularity, there hasn’t been a groundswell from the heavy civil construction industry supporting it, which seems more focused on price-driven procurement methods. Why is PDB of less interest to heavy civil contractors and what needs to change?

- Implement risk management training and tactics. Excessive risk transfer can lead to increased construction costs that are inflated to cover unknown project risk. Strategies to identify and balance risk can achieve better results.

- Is industry oversight lacking? Would increasing peer-to-peer interaction be of benefit to share our experiences and avoid unfavorable project outcomes?

Taking Action

When funding programs tie eligibility to schedule, using one, mega D-B or P3 contract may appear more efficient for public agencies. But we need to consider other contracting methods best suited for all industry players and changing market conditions.

The road to success starts with increased awareness and industry professionals in ownership, design and construction working together to address a resolve. To reach a steadiness in the market and balance the risk of alternative delivery mega-projects, insurance providers, legal and financial, and technical advisors must work with the industry professionals to play an equal and proactive role.

Sign up to receive an extended version of this article as well as all future articles in the Alternative Project Delivery series. This series will address challenges affecting the alternative project delivery market:

- Procurement Strategy

- Progressive Design-Build

- Design-Build Team Collaboration

- Training and Collaboration in Risk Management

- Advisors to Support Procurement Strategy